It was a busy service going into a busy weekend.

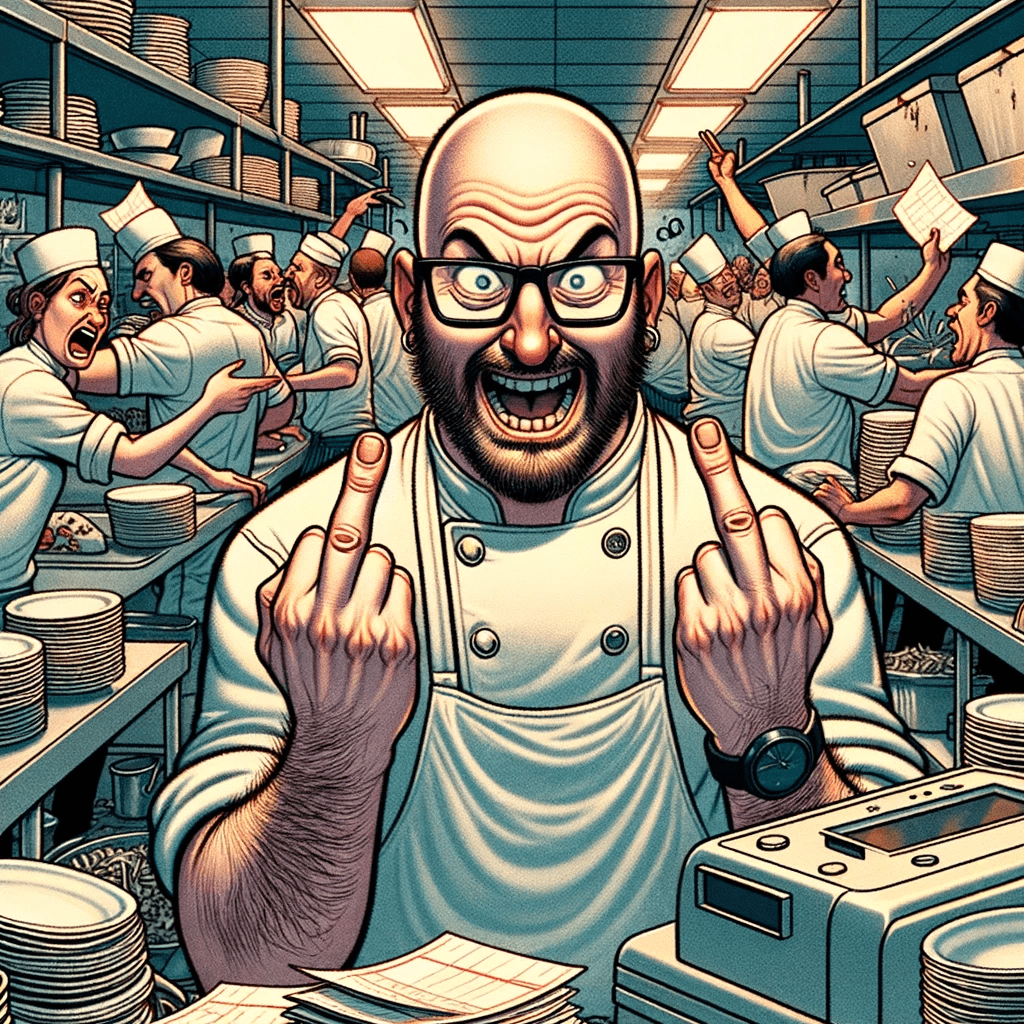

The kitchen was bustling the equipment was fired up, the cooks were nursing hangovers at their stations, and servers were folding their napkins and gossiping about last night. The hustle of the restaurant prepping for the evening. The orders had been put away, the prep and side work were being finished, all while the staff were eyeing the clock until pre-shift. Fucking pre-shift. I didn't have time for that. Not that night. There was more prep to do than time remaining, one of the guys didn't show up, and on top of all that, I hadn't had my favorite pre-service cigarette. I was wasting precious minutes of my life at the daily circle jerk. But it was necessary all the same, and I had to bring the shift information everyone needed. The job of the chef is primarily of time. Sell the product before it dies. The job of the front of the house is primarily sales. Sell as many products as possible to have the highest possible tip. I would try to come to pre-shift with some sampling of the featured menu items. A savory tasting of an entree special, or a decadent bite of an extra $12 on the tab, I was in it to sell out my product, and the front-of-the-house staff was in it to upsell and rack up check averages. But more importantly, pre-shift was the best chance to be ready. It was getting everyone on the same page. Pre-shift was counts on reservations, menu and drink items, times of large parties, and who's at the door so we know if we're getting flat sat or not. Of course, it wasn't perfect. There were services where pre-shift gave us the heads up to navigate a smooth and easy service, and there were pre-shifts where the night ended with servers crying outside and cooks scrubbing away their evening failures. But like life and in the restaurant, we can't control what happens, but we can plan for what's coming and handle it the best we can. What were the busy services without a pre-shift like? From selling 86'd specials, not knowing about the 20 top that just sat, and that jerk-off VIP that needed special treatment, it was relentlessly an unprepared mess. It was a failure before it began. FUBAR before the doors even opened. The staff was set up to lose. It was one of those thousand times I was ready to throw my apron down and double middle-finger my way out the back service door. But I came back because that's what I did.

| Image by Jerbear

Because that's what I do. That's what WE do. There's a romance to the grind in food and beverage. The long shifts, the physical toil, the partying; the routine. But what happens after? Seriously, what's the end goal? Executive Chef, Restaurant Manager, F&B Director, General Manager...? Well, that's not the end goal, that's just another step. I mean after the work stops entirely. When the music stops and there's no chair for you because you're too old or you're too broken. What then? Predictable and insufferable younger Ryan would have said, "It doesn't fucking matter man, I'm dead at 40." Dumbass. Then there were my coworkers, the people who had already called it quits 20-30 years out from retirement. They're the ones who said, "Oh I'll be working until I'm dead." Sad. When I think about it, the number of people who couldn't or wouldn't do anything about their retirement seemed like a lot. It seemed so normal that retirement was for "them," not for "us". In most cases, "them" were people in other corporate industries who have retirement plans through work, possibly some stock options and bonuses. They would have personal investments in assets like stocks, bonds, or real estate. Some people have pensions from their jobs, and some public service members like the military, first responders, or teachers would have government-funded pensions. Other forms of income could include investments like dividends or annuities. I guess there was a 401(k) option I paid into, but I thought that was trivial. Just more shit being taken out of my paycheck. Why was I like this? What was I not doing to protect myself? A pre-shift for my life. I like to think of retirement planning as pre-shift. The important tidbits needed to have a smooth retirement. Annual check-ups on progress to see how the plan is going, and what adjustments need to be made. Maybe even meeting with Retirement Advisors, Financial Planners, or Financial Advisors to have guidance on finding a plan that fits. To those who believe they are on their way to being able to stop working and enjoy life: I wish you the very best and most success in your journey. But who are the ones who don't believe they're on their way to retirement? Who feels confused, frustrated, or worse, hopeless about what their future looks like? Have you had your pre-shift? Do you know where to begin? Because whether you believe it or not, there can be a path to a life after working. The people who have convinced themselves that they are working until they die, just remember that the company's bottom line is more valuable than supplementing income because Social Security checks aren't enough. Social Security. I like to call that the cherry on the ice cream. Why? Because the Social Security Trust is expected to go insolvent in 2033. This means by then, monthly checks will be roughly 75% of projected income (1). Just for reference, the 2023 average Social Security income in the U.S. is $1,700 a month (2). Imagine living on that income now, or receiving 75% of that income, or potentially the income not even existing at all in the next 30 years. The reason why Social Security is the cherry on top of the ice cream is because the ice cream is the financial plan put in place to live beyond working, and the cherry is just a small part of the entire dessert. So, if Social Security isn't reliable, what else is there? What are the other ways to retire? Well, that depends on the individual. It depends on you. There is no one-size-fits-all approach to retirement, and there are many different strategies that have worked for many different people. Where it all starts though, is the plan. The pre-shift for retirement is based on strategy, time, product, and consistency. Each part is set up based on your lifestyle now and what you want your lifestyle to be when you retire. There is an understanding of how much is needed in paychecks (the income required to pay the bills), and play-checks (the payment required to do the fun retirement stuff). Everyone deserves to have a retirement. Everyone deserves to have a shot at being excited by the idea of hanging up the apron and doing the next thing. Even the word retirement is defined differently by each person. For many it's hopping between cruises, or golf trips, or cross-country traveling. But retirement can be going to a part-time schedule, becoming self-employed, or maybe starting another career without worry of financial impact. But no matter how it's defined, it starts with you, and nobody will be relying on retirement more than you.

There's still hope. I still have hope for you, and I don't even know you

I encourage you to pre-shift for retirement. It's the most important pre-shift, and nobody is taking it more seriously than you. When it comes to getting started, just get started. They say achieving great things isn't easy. Is it worth it for you to go on a journey where you can retire at the end of it? Isn't that a great thing? It's true what they say about the little things making the great things; the tiny seed that grows into the sequoia. Don't be that person who says, "Well Ryan that might work for other people but that won't work for me!" Well Negative Nancy, that's called attribution bias, and that is what's actually debilitating your retirement. 79% of millionaires did NOT receive an inheritance, meaning they had to do it on their own. And among those 79%, 80% grew up in families at or below middle-class income levels (3). A lot of it is just making smart choices and being consistent. If you felt like any of this resonated with you - good or bad, let's connect. As a former F&B employee, I can relate. If you're a person who wants to help themselves, I got your back. I work with a team of people ranging from Financial Advisors, Life and Health Insurance Agents, and a multitude of strategies across many financially strong companies. I'm not sure I can help you, but it would be worth a try! Ryan Janz Retirement Advisor

Trending

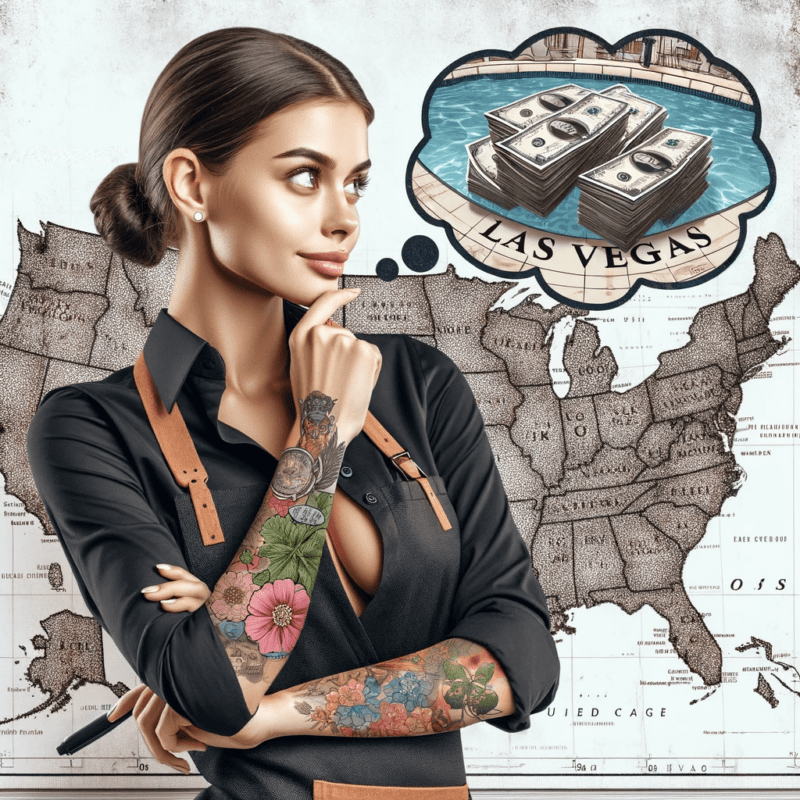

The Top 5 Cities For F&B’rs

Cities where we can flourish

Weighing Culinary Diplomas Against Kitchen Battle Scars

Who is the Bitchy Waiter

Darron Cardosa, known as The Bitchy Waiter, took his F&B…

Hooking Up With Coworkers

Is It Ever a Good Idea?

Top 5 Cities Where F&B Pros Shouldn’t Detour

The Hostess with the Mostless

If you’ve ever worked in a restaurant, you’ll recognize the…

$1.6 Million in Unpaid Tips head back to Servers Pockets

Explore the ongoing battle for restaurant workers' rights in South…

Drink Me

Dive into the "Traveling Bartenders" Facebook group, where bartenders find…

Serving Philanthropy with a Side of Santo

Guy Fieri shares insights on his tequila collaboration, life balance,…

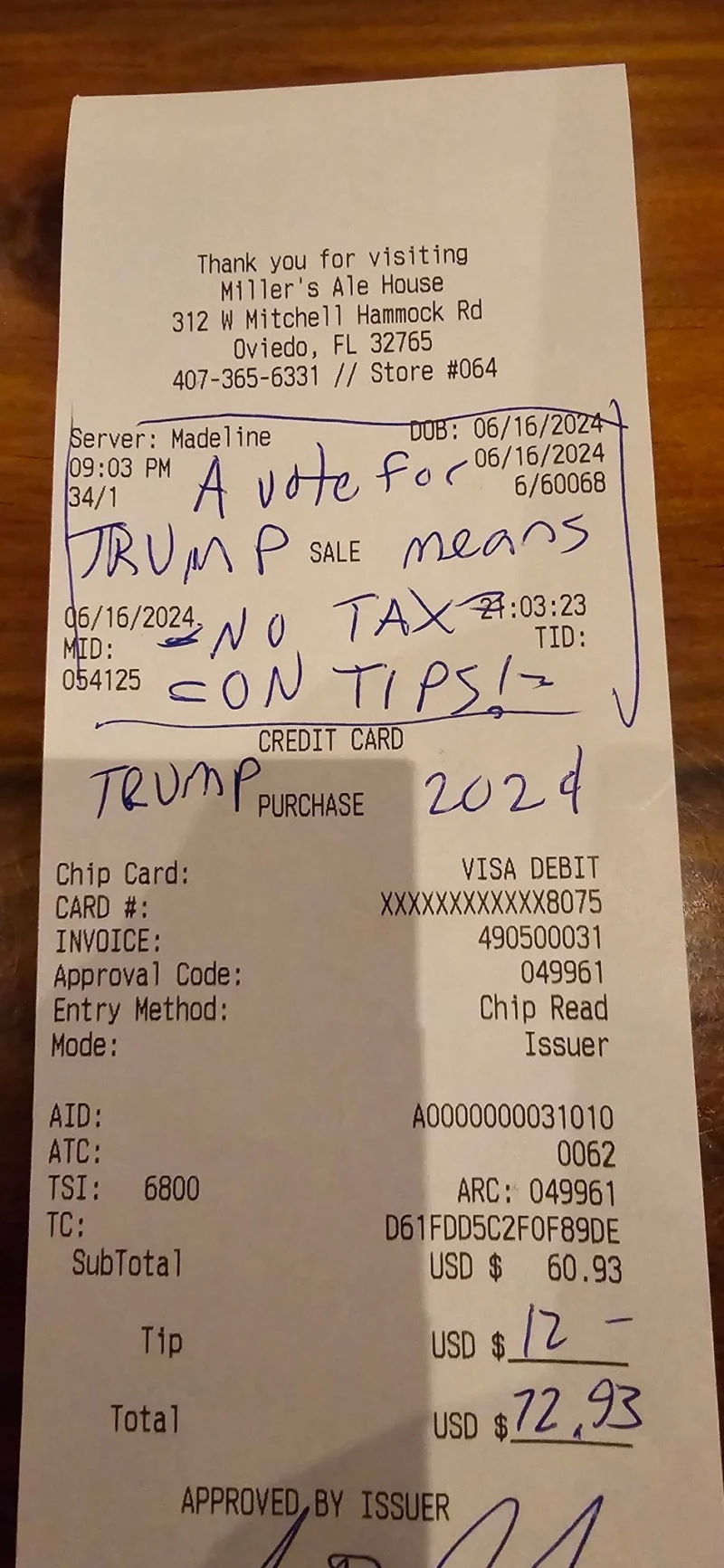

No Tax On Tips

Trump’s promise of no taxes on tips sounds great, but…