Dear Erica

I was feeling pretty sick the other day and called to let my manager know.

They told me I needed a doctor’s note to come back, even though I think it’s just a cold and don’t really need to see a doctor.

Is it legal for them to make me get a doctor’s note for something like this? What are my rights here?

—Caught a Cold

Dear Caught a Cold:

Colds are the worst.

My doctors usually just shrug with a list of all the available over-the-counter stuff and give me a pat on the back with a freshly sanitized hand.

An apothecary has a better chance of prescribing something than a doctor with cold symptoms.

Unfortunately, your employer can require a doctor’s note.

There is no federal or state law that specifically oversees the provision of a doctor’s note for taking a day off or calling in sick.

In some cases, employers require a doctor’s note because they genuinely care about your health and the safety of other employees and customers.

Other employers are less concerned about the wellbeing of others, and more concerned about alleged abuse of calling out –

they want a note as evidence that their employees were legitimately sick.

Either way, the employer can ask for a note if it chooses.

As a side note –

imho – staying home and not giving your coworkers your cold was the right thing to do.

Dear Erica,

The restaurant where I work has us come in and do 1 hour of side work before we start and then we are sometimes required to do 1-2 hours of side work after our tables are all gone.

Is this legal? If so, should we be getting paid minimum wage?

What if our minimum wage includes a tip credit?

—Side Work Never Ends

Let’s take a moment to clarify something important

Side work is still work.

Side Work | Image by Side Work

You are still performing work.

Just because we call it “side work” does not make it a voluntary task that you are doing out of the kindness of your heart.

So, first thing first, you should be getting paid if you are performing work for your employer. This goes for all employees with any employer.

Now, of course, if you work in a state that allows for a tip credit, it can throw a wrench into things, but it doesn’t change the fact that you should still be paid for performing work.

Under the Fair Labor Standards Act, full minimum wage – not the state minimum wage with a tip credit –

should be paid for non-tipped work if the employee performs that non-tip-producing work for a substantial amount of time.

What is substantial?

Well, under the FLSA, it means more than 20 percent of the hours in a workweek for which the employer has taken a tip credit or performing

supporting work for a continuous period of time exceeding 30 minutes.

In this “hypothetical” situation, it sounds like restaurant management is asking employees to perform non-tip-producing work in excess of 30

minutes a day at the beginning and/or end of their shift.

The full minimum wage should be paid in those situations if it exceeds 30 minutes.

For more information on this rule under the FLSA with some enlightening examples, take a look at

Fact Sheet #15A: Tipped Employees under the Fair Labor Standards Act (FLSA) and Dual Jobs.

Dear Erica

Lately customers have been asking if they can tip me with Venmo or Zelle. If I say yes am I breaking the law?

—Right Side of the P2P App

Venmo, Zelle, Paypal and any other peer-to-peer payment (P2P) apps that the cool kids are using these days have made our lives somewhat easier.

Some enlightened guests have even used these apps to pay each other for their share of the meal instead of asking their server to split the check-in 5 convoluted ways.

Guests are apparently evolving and want to tip servers using the apps.

The short answer is that you can more than likely accept tips via these P2P apps from guests.

However, a few words of caution – These apps are not insured. If the guest accidentally sends money to the wrong person,

you and the guest are at the mercy of the app to determine if there is any refund or dispute resolution process.

There is also an increased risk of fraud since you are potentially giving your information over to a guest.

And finally, you must also continue to follow any IRS regulations related to reporting income and tipping out any of your co-workers.

And while you may think this is like cash, it isn’t. The apps make it easier for banks, other institutions, and government agencies to follow a paper trail.

Keep that in mind if you accept any tips via one of these P2P apps.

On the bright side, at least the guests are trying to find a way to leave a tip as opposed to the alternative…

Dear Erica,

I occasionally work banquets and private events at a nice hotel. The hotel charges a 22% service charge to its clients and charges a $200 bartender fee.

I bartend at the events and often receive less than the $200 bartender fee.

I feel they are taking money off from the top - mafia style. I'd like transparency on where these charges are going.

—Service Charge Confusion

Dear Service Charge Confusion:

As a consumer, I detest these service charges. As a bartender, it sounds like you do too.

Business owners and management disagree with both of us. Some states recognize that these service charges are confusing and try to help by creating laws requiring transparency when communicating where the service charge is going.

Those states are far and few between.

The only thing where employers, employees, and customers agree – service charges and how to categorize them are confusing.

The IRS put a news release in 2015 to help employers, but even that is not always the most helpful to employees.

The federal law usually categorizes service charges as a compulsory charge for service, for example, 22 percent of the bill, but does not consider the service charge a tip.

Even if the hotel distributed sums from the service charge to the employees, it is not considered a tip.

The employer could use that money to be part of the employee’s “regular rate of pay”.

For customers, it may appear to replace the tip, but that is not always the case. Again, some states require clear disclosure, ahem… transparency, on who receives the service charge.

But not all states and some of those states’ transparency requirements could be confusing as well.

If you have questions on your state law, reach out to your state labor office that specializes in wage and hour laws. You can find a list of each state’s labor office at https://www.dol.gov/agencies/whd/state/contacts.

Dear Erica,

I work at a brewery that does private events.

The brewery has recently decided that all events will be paid at $25/hr.

We are permitted to accept cash tips, but if a customer pays on a card and adds a tip, we do not receive that money.

Is it legal for the house to keep tips that are written on credit card transactions?

— No CC Tips for Events

Dear No CC Tips for Events:

Wow – just wow. If you don’t remember anything else, please remember this one rule: employers, including managers and supervisors, may not “keep” tips.

Federal law, specifically the Fair Labor Standards Act (FLSA), prohibits employers from keeping any portion of employees’ tips for any purpose, whether directly or through a tip pool, and even in the case where there is a tip credit.

Under my favorite federal law, the FLSA, there is some allowance for the employer when the credit card company charges a percentage as a fee for payment for using the credit card.

When tips are charged on customers’ credit cards and the employer can demonstrate that it pays the credit card company a percentage as payment for using a credit card, the employer may deduct the percentage from the tip it pays the employee.

For example, where a major credit card company charges an employer 5 percent on all sales charged to its credit service, the employer may pay the tipped employee 95 percent of the tips without violating the FLSA.

However, the employer cannot reduce the amount of tips paid to the employee by any amount greater than the transactional fee paid to the credit card company. If it did, it would likely be a violation of the FLSA.

Note: Some states may have more protective laws regarding tips charged to credit cards which do not allow the employer to deduct credit card fees from employees’ tips.

Dear Erica,

I just started a new waitressing job. they started me at $15/an hour.

But we don’t keep any of our tips! is this legal?

I’m based in New Mexico.

—Can’t Receive Tips

Dear Can’t Receive Tips,

I really want to get angry for you. Let’s be honest, most of the service employees working in restaurants earn more money from their tips rather than the hourly wage. It feels like something is wrong, but my feelings are worth absolutely nothing.

The dirty truth is that when you receive tips, the legal rights become complicated.

Most rules about tips depend on state laws, but federal, state and local laws – whichever is more generous to the employee – governs.

The basic rule under the federal Fair Labor Standards Act (29 CFR 531.50) is that an employer cannot keep an employees’ tips. Tips belong to the employee. Not the employer. Not the manager. Not the supervisor.

However, there are always exceptions!

Some state laws, including New Mexico, allow an employer to take a tip credit. A tip credit allows the employer to count all or part of an employees’ tips towards its minimum wage obligations. They are not “taking” the tips in violation of the FLSA.

If the employee doesn’t make enough in tips to make at least minimum wage for each hour worked that week, the employer must make up the difference.

While your situation does not sound like a tip credit situation because they are paying you above minimum wage,

I would specifically ask management whether they are using a tip credit. Maybe they have a backwards explanation for what is happening. Maybe not.

Either way, they should have a very good reason why you cannot keep your tips.

And feel free to show them federal law because an employer cannot require an employee to give their tips to the employer, even where a tipped employee receives at least the minimum wage per hour in wages directly from the employer and the employer takes no tip credit.

Anyone can check with their state Labor Commissioner or Labor Relations Division for any specific state law questions or to make any complaints related to tips or other wage issues. .

Dear Erica,

I Work At A 9-5 In Technology And As A Manager At A Restaurant For 40-50 Hours A Week.

Recently, The Restaurant GM Was Complaining That I Get Paid Too Much Because Of My Other Job And That If I Didn't Quit My Technology Job, I Would Be Paid Less And No Longer Be A Salaried Manager.

I Would Be Demoted To An Hourly Manager Without The Option Of Working Overtime.

The GM Even Said That Once I Actually Left My Second Job, I Can Return To A Salaried Manager At My Original Rate.

Is This Legal?

—

Dear Moonlighting in Technology,

It looks like this GM needs a bit of education. While being a poor manager is not illegal, the GM may have been close to walking the line.

- First, certain states require a certain amount of advance notice before they change your salary or hourly wage. Check with your state on whether that is required.

- Secondly, it sounds like the GM was using the second high-paying job as a reason to demote you. Federal law does not prevent employers from asking about an employee’s financial information. But the federal equal employment opportunity laws do prohibit employers from illegally discriminating when using financial information to make employment decisions.

- Employers must not apply a financial requirement – or more importantly, any employment decision – differently to different people based on their race, color, national origin, religion, sex, disability, age, or genetic information.

- They also must not have a financial requirement if it does not help the employer to accurately identify responsible and reliable employees, and if, at the same time, the requirement significantly disadvantages people of a particular race, color, national origin, religion, or sex.

- If you feel like your employer was using financial information to discriminate against you for an unlawful purpose, you should go to the EEOC or your state equal employment office to file a complaint. However, be aware of deadlines to file.

Dear Erica,

I Recently Left A Restaurant Because The Gm Was Complaining That I Get Paid Too Much Because I Also Work A Second Job In Technology.

During The Meeting, I Was Asked Questions About My Family. The Gm Asked, "Why Don't You Just Pull Your Daughter Out Of Daycare?" Or "Can't Your Wife Pick Up More Shifts?”

I Felt These Were Inappropriate. To Say That I'm Hurt And Offended Is An Understatement.

—

Dear Moonlighting in Technology,

Sometimes companies, even those in hospitality and food and beverage, fail at teaching their managers how to be managers. They fail at how to be hospitable humans. They fail at teaching them how to communicate.

Her questions about your personal life were completely inappropriate. I understand why you would be offended.

Yet, they were not illegal. More importantly, it would not have been illegal for you not to answer them. If a manager asks you inappropriate questions about your personal life, I recommend that you politely decline to respond.

If they insist, find out why that information is important. It could help determine if they are asking questions for discriminatory or unlawful reasons.

If you have any F&B legal questions you’d like answered here email us at [email protected]

86'd Me Magazine - The Legal Dish Article Cover | Image by Jerbear

Trending

The Top 5 Cities For F&B’rs

Cities where we can flourish

Weighing Culinary Diplomas Against Kitchen Battle Scars

Who is the Bitchy Waiter

Darron Cardosa, known as The Bitchy Waiter, took his F&B…

Hooking Up With Coworkers

Is It Ever a Good Idea?

Top 5 Cities Where F&B Pros Shouldn’t Detour

$1.6 Million in Unpaid Tips head back to Servers Pockets

Explore the ongoing battle for restaurant workers' rights in South…

The Hostess with the Mostless

If you’ve ever worked in a restaurant, you’ll recognize the…

Serving Philanthropy with a Side of Santo

Guy Fieri shares insights on his tequila collaboration, life balance,…

Drink Me

Dive into the "Traveling Bartenders" Facebook group, where bartenders find…

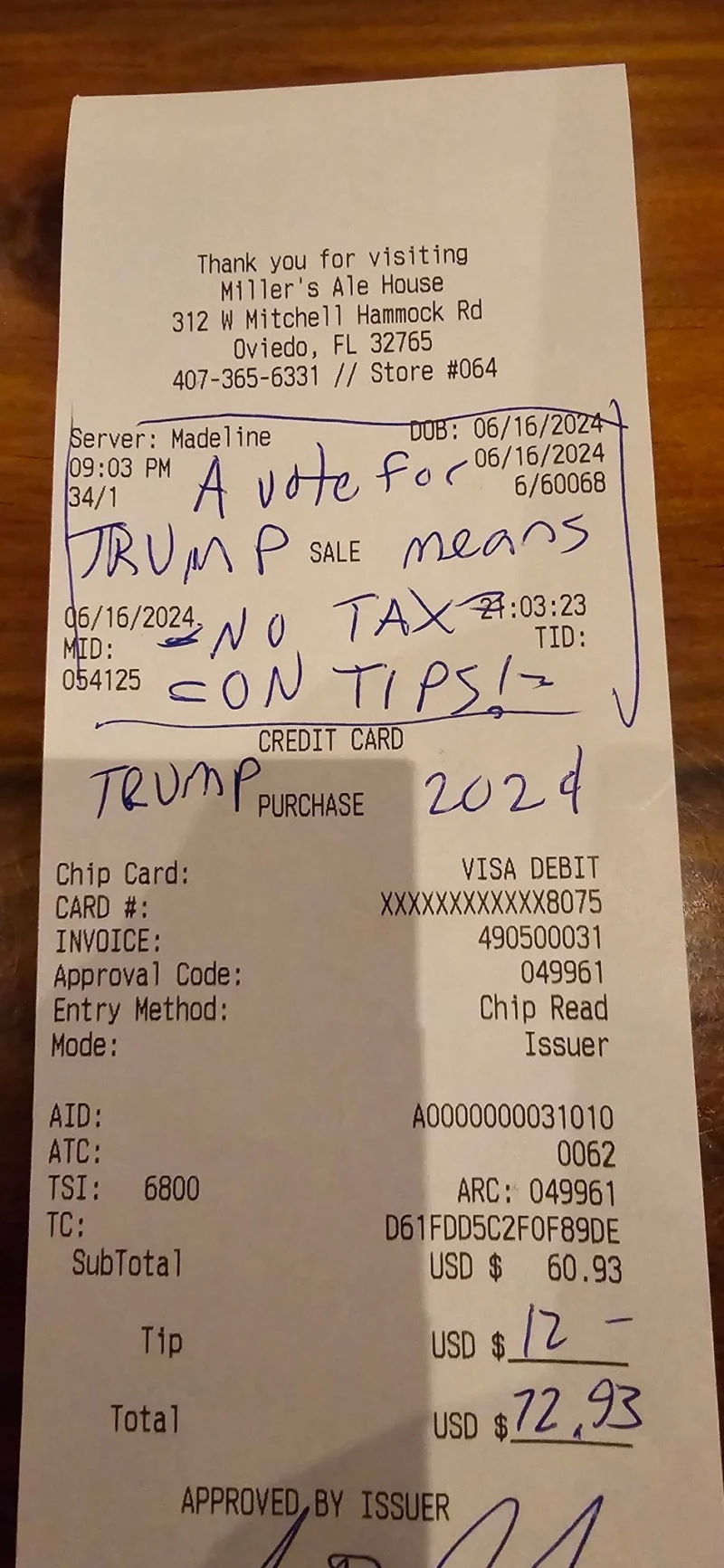

No Tax On Tips

Trump’s promise of no taxes on tips sounds great, but…