Is anyone with me thinking this no-tax-on-tips thing is out of hand?

I’m sure you’ve seen this on credit card slips or heard about it from the media or other F&B’rs it’s everywhere. This claim is that if you vote for Trump, he’ll eliminate taxes on tips.

Normally, I stay out of politics, but this directly involves hospitality workers. I’ll try not to state my opinions

I’ll try to stick to facts with a little humor and sensibility.

Back in June, during a rally in the crucial swing state of Nevada, Trump suggested not taxing tips for “restaurant workers, hospitality workers, and anyone else that gets tips.”

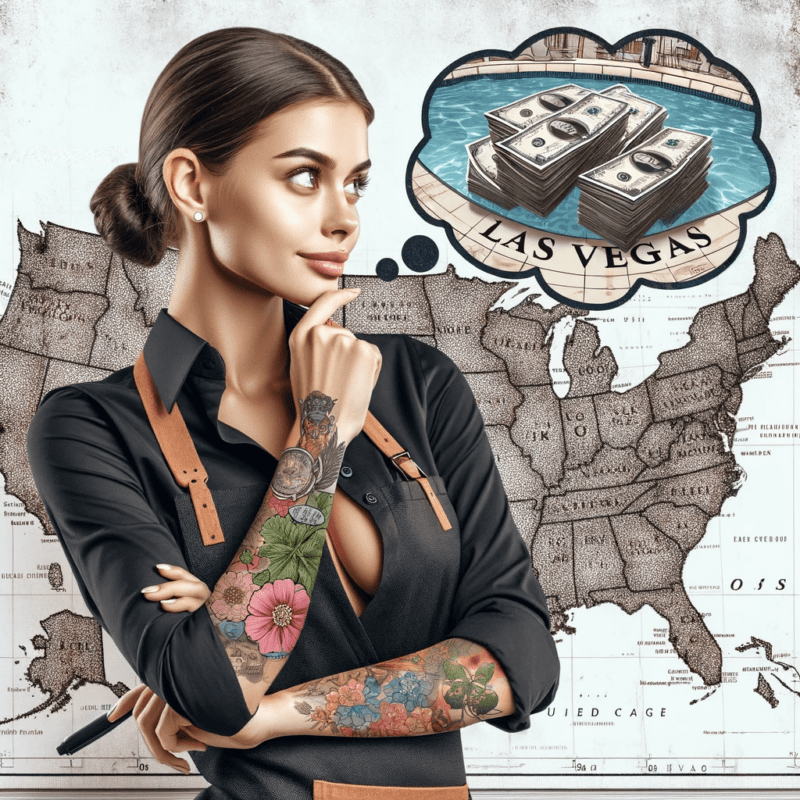

Obviously, this sounds like a great idea, right? For a lot of us working in states that still have a tip credit and pay around $2.13 an hour, it especially sounds great.

If you live in Nevada making $12-plus an hour with no state income tax, it really sounds great. Almost too good to be true.

Of course, Trump’s always got our best interests at heart, right?

If you buy that, you might also think O.J. was framed, Santa’s still making his rounds with Rudolph, and the earth is as flat as a pancake.

As reported by The Washington Post.

In 2017, the Trump administration’s Department of Labor (DOL) released a proposed rule that would allow restaurants to take the tips that servers earn and share them with untipped employees such as cooks and dishwashers and other restaurant staff.

But here’s the twist: as long as workers received minimum wage, the owners could just keep the tips.

This rule would have put $5.8 billion into the hands of owners, not workers. Saru Jayaraman, president of Restaurant Opportunities Centers United (ROC), an advocacy group for restaurant workers, said

the regulations were not just about sharing tips with the back-of-the-house staff—that part would be okay—but employers would have the right to decide what to do with the tips.

So why would Trump give a damn about us now?

He doesn’t.

And now the Democrats have joined this ridiculous pandering for votes.

Harris is vowing the same thing.

Like I said, the idea of taking home more money is a daydream both politicians are tapping into. But here’s the reality:

Pandering |

The president can’t just wave a magic wand and change tax laws!

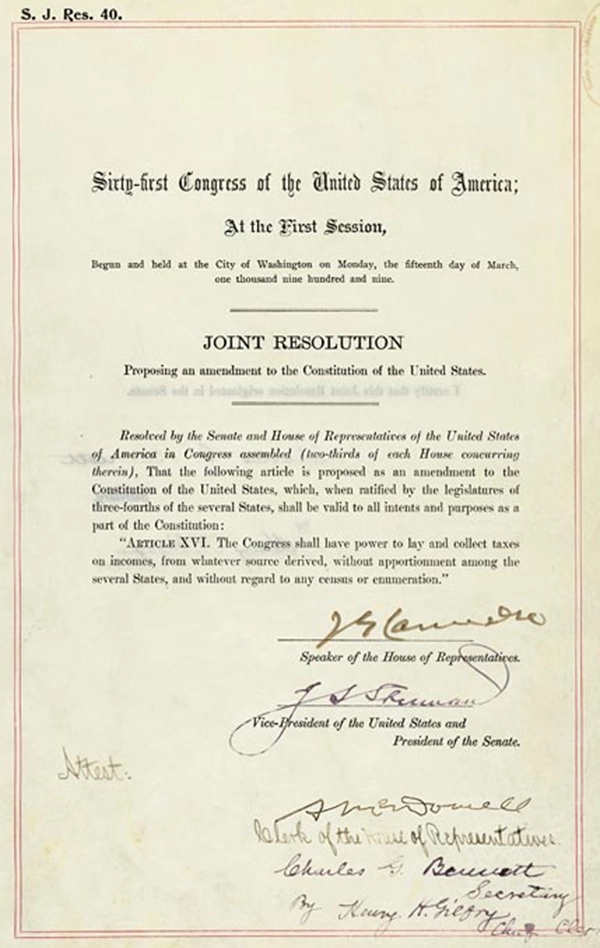

How Tax Laws Actually Get Changed

To really change tax laws, including exempting tips from taxes, there’s a whole process that involves more than just a president making promises at a rally.

First, a bill has to be drafted—this is a detailed proposal that outlines exactly how the tax change would work.

This bill then goes to Congress, where it needs to be reviewed by committees that specialize in tax policy. They can make changes, throw it out, or push it forward.

After that, both the House of Representatives and the Senate have to vote on the bill. And here’s the catch

if the majority in Congress doesn’t agree with the president or doesn’t think the proposal is a good idea, it’s dead in the water.

Even if it passes both houses, the president can sign it into law, but if he vetoes it, Congress can override the veto with enough votes. It’s a complex process designed to make sure that changes to something as important as taxes don’t happen on a whim.

And here’s the kicker—neither Trump nor Harris has laid out a detailed plan on how they would actually make this happen. It’s one thing to make promises; it’s another to navigate the maze of Congress, especially with a proposal that could have such massive economic implications.

The True Cost of This Political Fantasy

The idea has caught on like a California wildfire with workers and even some unions, but economists on both the left and the right are sounding alarms about unintended consequences.

According to the Committee for a Responsible Federal Budget, the plans could cost between $100 billion and $250 billion over a decade, depending on what they include.

That’s a massive hit to federal revenue, and let’s be real—who’s going to pick up the tab?

It’s not just the rich who would feel the impact; cuts to essential services and programs like Social Security and Medicare could follow to cover the shortfall.

And what about the risk of abuse? Economists warn that giving tax advantages to one type of income—tips—over others could create a loophole that high-end earners, like financiers, might exploit by reclassifying their income as tips to avoid taxes.

This concern isn’t just a theory. It’s a very real possibility that could lead to a plethora of consequences.

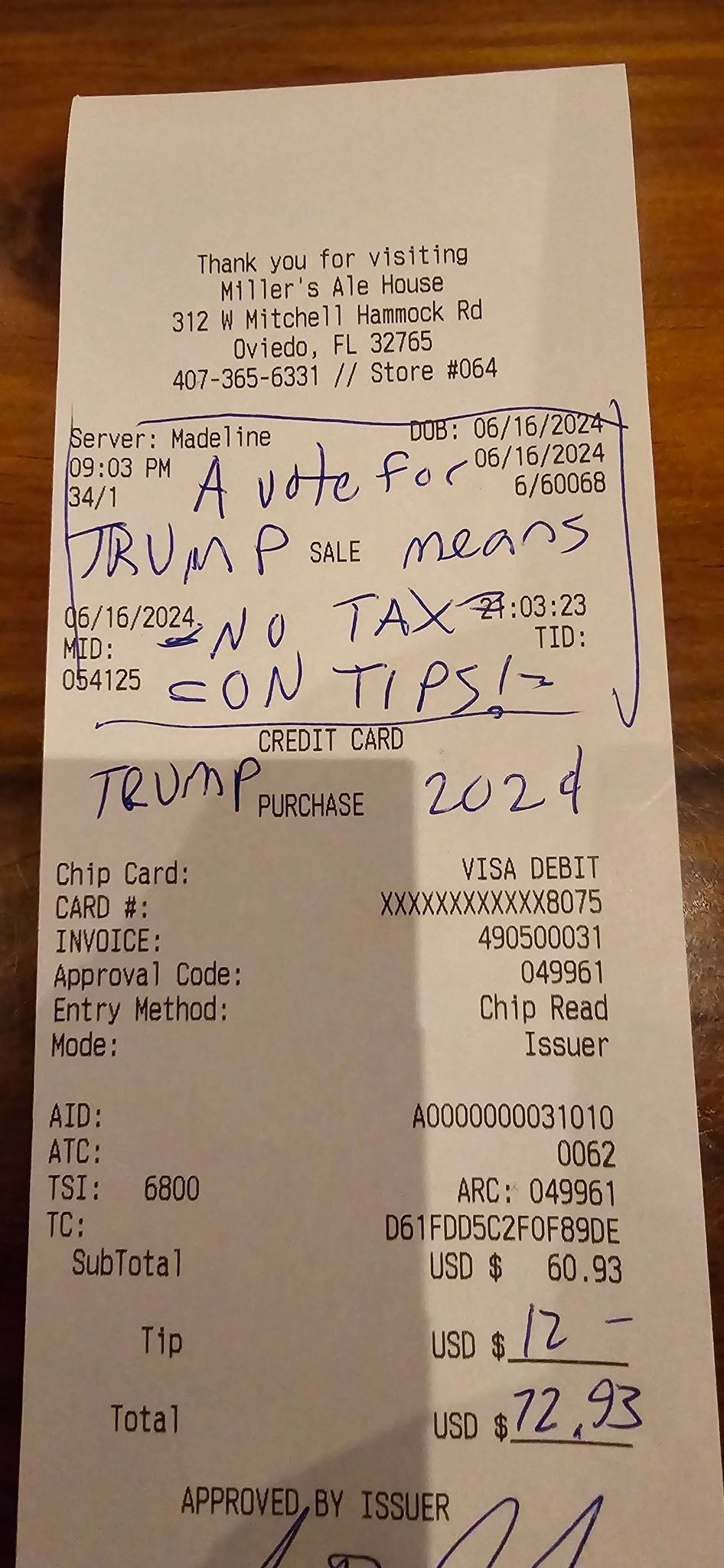

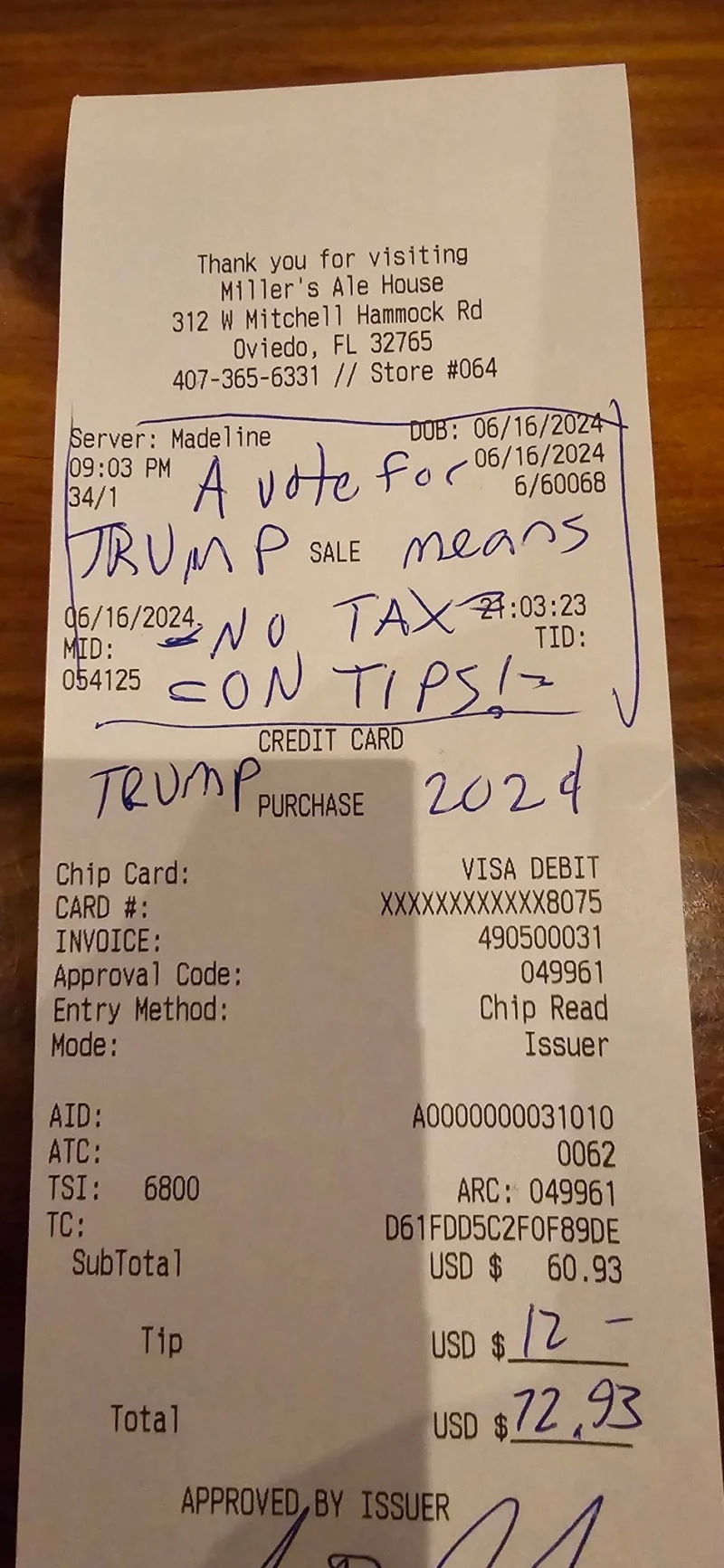

Adding fuel to the fire, Trump has even encouraged people to write “No Tax on Tips. Vote for Trump” on their credit card slips. It’s a catchy slogan, but it’s far from a solution.

This kind of oversimplification is exactly what makes this issue so dangerous—it’s all talk and no substance, a shiny object meant to distract rather than deliver real change.

Do we really think Congress, especially a divided one, is going to push this through? Not likely.

They’d have to find a way to replace that lost revenue, and no one wants to be the politician who raises taxes elsewhere to make up for it. So this idea of no taxes on tips?

The 16th Amendment | Image by The 16th Amendment

It’s a political fantasy, a shiny object to distract and win votes, not a serious policy proposal.

So before we get too excited about taking home a little more money, let’s remember that the devil is in the details.

People, be smart—no matter who you vote for, just don’t let this be the tipping point to swing one way or the other. (See what I did there?)

Like what you’re reading?

Trending

The Top 5 Cities For F&B’rs

Cities where we can flourish

Weighing Culinary Diplomas Against Kitchen Battle Scars

Hooking Up With Coworkers

Is It Ever a Good Idea?

Who is the Bitchy Waiter

Darron Cardosa, known as The Bitchy Waiter, took his F&B…

Top 5 Cities Where F&B Pros Shouldn’t Detour

$1.6 Million in Unpaid Tips head back to Servers Pockets

Explore the ongoing battle for restaurant workers' rights in South…

The Hostess with the Mostless

If you’ve ever worked in a restaurant, you’ll recognize the…

Serving Philanthropy with a Side of Santo

Guy Fieri shares insights on his tequila collaboration, life balance,…

Drink Me

Dive into the "Traveling Bartenders" Facebook group, where bartenders find…

No Tax On Tips

Trump’s promise of no taxes on tips sounds great, but…